Launched 2 years ago, and after successful testing in the U.S., Canada, and several European countries, MasterCard’s “Identity Check mobile” technology is now spreading worldwide. Leading the way in biometric identification technology, It’s now being launched in Latin America, one of the fastest growing regions for e-commerce after Asia Pacific. The first two countries in the area to welcome “Selfie Pay” features are Brazil and Mexico – the two largest online retail markets in the region accounting for more than 50% of sales.

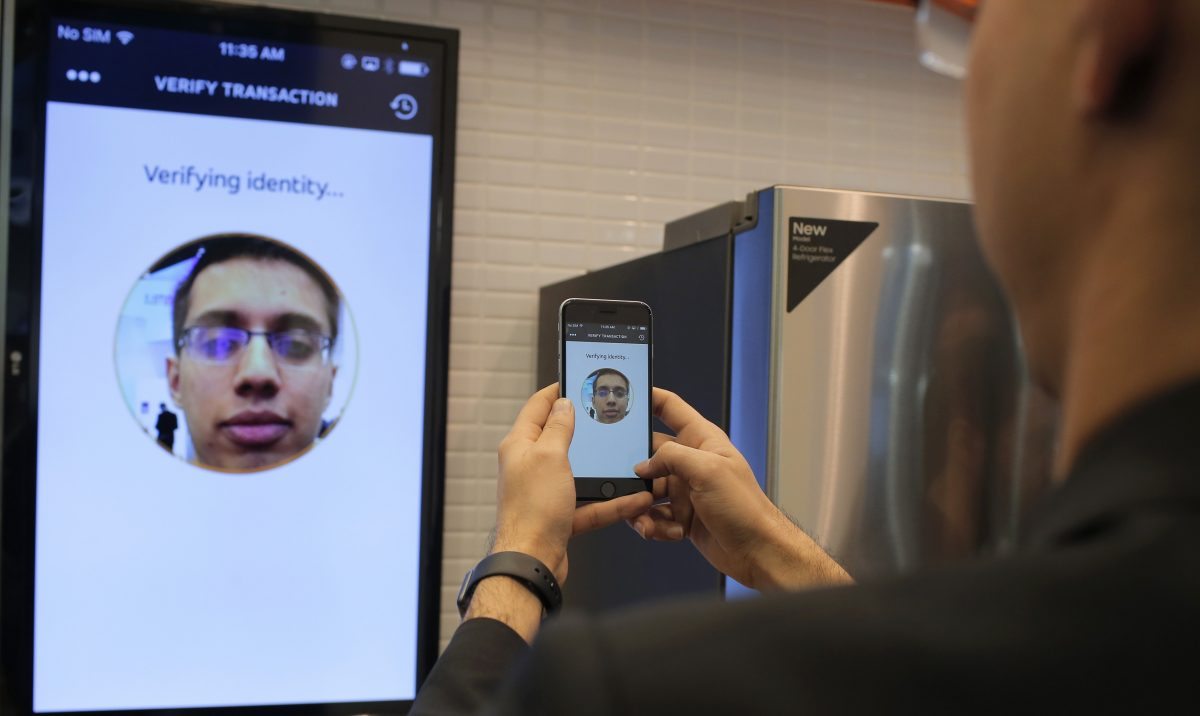

It’s official name is “Identity Check,” which is a payment app that allows cardholders to authenticate online payment through biometric identification via scanning their fingerprint or by using facial recognition. Analysts predict it will have a huge success. The Latin America penetration that was about 32% in 2014 is predicted to reach 70% by 2020, positively influencing e-commerce activities.

An increase in smartphones and e-commerce is likely to increase the fraud attempts as well. Besides, the password and other codes system can be boring as well as time consuming for customers, often leading to cart abandonment or declined transactions. It is then easy to understand why biometric identification technology is becoming a booming trend in e-commerce.

MasterCard’s Identity Check technology is useful for both online shoppers and retailers by securing the payment process through analyzing unique personal data that only the user can possess. Of course, questions are raised concerning the potential lack of security by using a photo to workaround face scanning, and MasterCard has already thought of this. The app requires the user to blink to prove that they’re not just an image.

What do potential users think of MasterCard’s Identity Check for Payment Purposes?

Perhaps most importantly, how do users react to biometric identification to complete their mobile payments? According to MasterCard’s survey:

- 90% of users think MasterCard Identity Check is more convenient than what they use today

- 93% want to use biometrics for online payments

- 93% rate fingerprints recognition is highly convenient

- 92% want biometrics to replace password for mobile banking login

- 83% think the system is more secure than passwords

- 73% believe it will reduce fraud

- 72% find MasterCard Identity Check more secure than what they use already

- 71% rate facial recognition is highly convenient

For more information on how users react to the possibility of using biometric identification for mobile payment, check out the infographic below:

By and large, e-commerce customers are ready for biometric identification to facilitate their mobile purchases. They believe that it’s not only more secure, but more convenient.

Biometric identification technology has the wind in its sails

Biometric identification is a growing market and the desire of innovation in this field is not new. In 2015 Jack Ma, founder of Alibaba, already talked about a “smile to pay” innovation , allowing customers to pay without password and connecting with it’s Alipay platform for more security.

The concept of biometric recognition payment is spreading as more and more users are eager to change their payment method, especially online. Especially on mobile, the online checkout process can be tedious, including passwords, redirections to users bank pages where to insert a code received on the cellphone, and so on.

Both Apple and Samsung have released their own payment options to enhance contactless payment. Vocal and fingerprint recognition for identification is already used, and eye scanning technology is currently in development. Amazon is also currently working on its own facial recognition system as well.

There’s no end in sight for this trend: Alibaba is currently working on other ID verification systems such as “EyeVerify” to authenticate identity through a user’s iris and “Kung fu” which will scan a user’s unique characteristic, such as a tattoo.

As Biometric identification is widely spreading around various domains and uses, it rises a new concern. The next big step for firms like Mastercard, Alibaba, and others using the biometric identification will be to ensure their customers that their extremely personal data (physical characteristics, tattoos, etc) are going to be stored and protected adequately.

As they expressed, Mastercard wants to “simplify the online payment experience, without compromising security.” With the implementation of Biometric identification technology, the e-commerce and payment process are about to face a turning point making it extremely secure and thus encouraging even the more reluctant customers to purchase online.