There has been a rise in the demand for new forms of digital payments which are much more secure and reliable. This has been able to transform payments into an open ecosystem where various parties like FinTechs, banks, payment firms etc are trying to evolve the digital payment system by introducing new technologies. The government, on their part, are trying to come up with certain regulations in order to reduce the ecosystem threats.

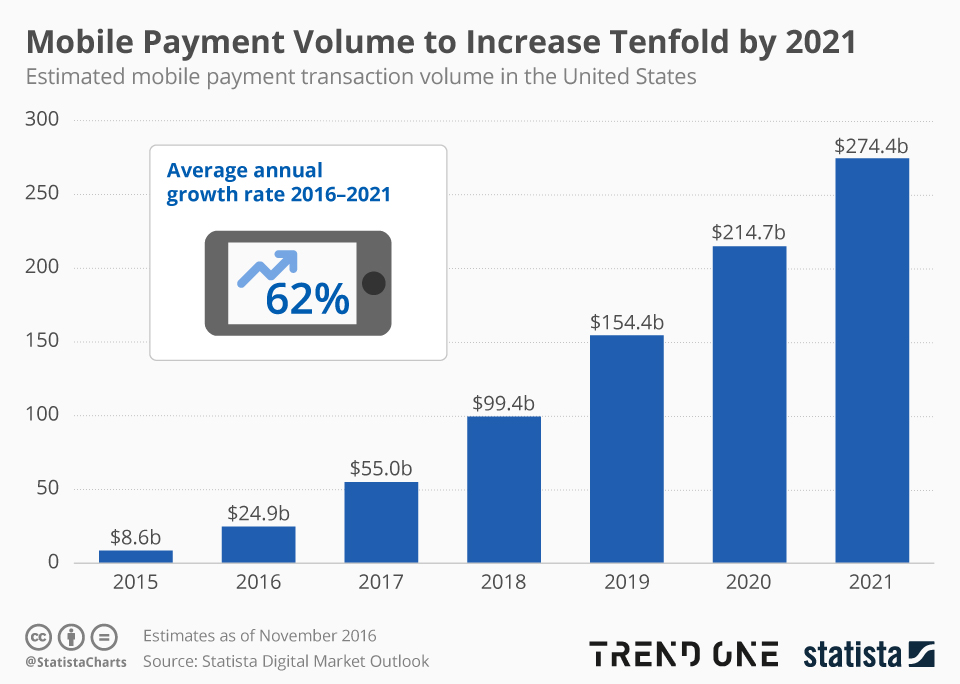

We were able to notice a massive growth in the digital payment transactions in the span of 4 to 5 years but with the pandemic the growth was motivated by the need for cashless and contactless payments. Thus Non-cash transactions are seen to be on a robust growth path.

Cards seem to dominate the in-store retail channel, but mobile wallets like Apple Pay are seeing a rapid uptick in usage and paving the way for the future of payments. E-commerce is seen to chip away at brick-and-mortar retail as smartphones attract a rising share of digital shopping. Digital peer-to-peer (P2P) apps are supplanting cash in the day-to-day lives of users across generations as they become more appealing and useful than ever.

Digital payments are expected to reach $4.4trn transaction value this year. According to data gathered by BuyShares, China, and the United States, as the world’s two largest digital payments industries, are expected to generate 65% of that value. According to Statista total transaction value of Digital Payments is expected to show an annual growth rate (CAGR 2021-2025) of 12.00% resulting in a projected total amount of US$10,520,219m by 2025.

We can even see in the following chart by Google Trends how the demand for Digital Payments has risen in the span of 3 years.

This proves that Digitalization in the field of Payments has become very important and necessary at the same time as it has the following advantages:

-

Faster Transactions

Apart from being convenient, and digital payments are faster. Cash at pickup windows means line-ups. In-app payments or tap and go are faster and take seconds at checkout.

-

Global

In the case of online payments, you do not have any constraint of time or location. You can easily make payments at any time from anywhere across the globe.

-

Secure

Electronic payment systems offer you multiple ways of securing your payments such as tokenization, encryption, SSL, etc. Now your customers do not have to enter their card details every time as they can save their card details or complete their transactions by using a One Time Password.

-

Economic

If you are using an electronic payment system in your business then you do not have to incur high charges of registering payment gateways. You just have to pay a fixed subscription to your service provider.

-

Contactless

In the times of COVID-19 it is very much important to have contactless payments in order to avoid human touch. In this scenario methods like contactless POS terminals, QR code or OTP (One Time Password) Payments come into use.

This makes us really excited to see what 2021 would have in store for us regarding the digital payments

1. AI and ML influence Digital Payments.

For a long time financial companies have been using Artificial Intelligence and Machine Learning for the use of fraud detection and process automation but their capabilities are not just limited to this field. With the help of AI embedded tools you can:

- read customers’ operations history

- analyze their buying and spending habits

- predict their future activity.

There are a variety of uses in digital payment fields where AI can be helpful like:

-

Banking Chatbots-

Chatbots have proved to be providing an improvement in customer experience and when mixed up with the banking sector it would be helpful in solving user’s payment issues and queries in a faster manner. Banks like ATB Financial and the Bank of America (BoA) have been early adopters of AI chatbots. Banks like ATB Financial and the Bank of America (BoA) have been early adopters of AI chatbots.

-

Payments through Social Media-

The earliest digital payment trend to be seen in the year 2021 was the fusion of payments and social media. Facebook, Alibaba, and several other companies have made the most of fusion by bringing payment solutions through messenger apps. Amazon has now followed suit by working on a messaging platform known as Anytime.

-

AI Bots on Facebook-

Financial companies and banks have put AI bots on Facebook Messenger to handle payments and offer personalized customer services. One such company to be performing this is American Express(AmEx) that has a dedicated chatbot on Messenger for sending transaction notifications and benefit reminders to users.

2. Biometric Authentication

As the World of Payment is getting digitized the threat to payment security is becoming a very important issue to take in consideration. Biometric Authentication helps to identify and authenticate a person based on recognizable, unique, specific and verifiable data. There are various types of biometric authentication-

- Fingerprint Scanners

- Facial Recognition

- Voice Identification

- Eye Retina Scanners

According to a market forecast by Statistics Market Research, the biometrics market will be worth $76.64 billion by 2027 after increasing from $17.28 billion in 2018, at an 18 percent CAGR. While in banking and finance sector, the market for biometric technology is supposed to increase at a rate of 16.2 percent CAGR which would make a total market of over $7 billion by 2025.

Thus there are various benefits to be considering biometric authentication as one of the prime digital payment trends.

-

Convenient-

This technology makes digital payments fast, easy and effortless for consumers as it requires only the physical presence of the consumers

-

Card PIN not required-

There is no need to remember pin numbers of debit/credit cards as they are not required in the transaction with biometric authentication.

-

No limit on amount spend-

Usually there is a usage limit set on credit/debit cards and even contactless payment because of the risk of fraudulent purchases and theft. But a consumer does not have to worry about this while using biometric authentication technology

-

More reliable and secure-

The biometric technology can definitely be regarded as safer and more secure than other payment methods because of the use of encrypted and unique data. This way even if the card is stolen or lost , it cannot be used for low value contactless payments.

3. Cloud Based Payments

One of the biggest challenges for businesses are late payments which has a negative impact in the overall business operations. But the upcoming Cloud technology is able to solve this problem by using a network of remote servers that are available on the internet. In fact these servers store and manage data rather than a local server. Cloud based digital payment technology can be put to various uses like:

- e-invoicing

- automated payments

- the payments can be received and sent within a single click

A cloud-based ERP accounting solution provides the business flexibility to ensure that the financial data is safe and secure. This saves a lot of effort and time. Also, you don’t have to manually track the invoices. Cloud helps in promoting automation reducing manual processes and human errors. With cloud computing, in addition to e-invoicing and automated payments, the payments can be received and sent within a single click, saving your relationships with the customers.

Automation helps to have more transparency and visibility in all the transactions that are carried out by your customers. Your customers are notified in real-time ensuring their numbers are spot-on, thus, dissolving any chances of disputes.

The benefits of cloud computing are

- flexibility

- faster cash flow

- automation

- high security

- get rid of the perils of late payments

- cost-effectiveness

- feasibility

- reliability

- boost higher productivity.

4.B2B Digital Payments are trending

With the digitalization of payments, the number of B2B transactions are on a rise. The US B2B payments market alone is valued at $25 trillion and is growing at a CAGR of 5.8%

Recently customers have indulged themselves in the habit of faster and convenient payment processes. Due to this they are expecting the same level of service from the B2B payments and transaction banking. This is the reason customers are heavily demanding for personalization, customization, and for reconstruction for the corporate world.

To achieve this state B2B companies are supposed to integrate finance into their own payment systems, which would influence B2B buyers to establish relationships totally with the business that offers such an environment.

The B2B digital payments have the following benefits

- payment transparency

- 24*7 availability

- affordable payment costs

- option of last minute payments

The B2B payment system will provide you facilities like integrating digital payments, digitizing payment scheduling, invoicing, etc. The B2B or Business to Business Payment system is a transparent system on which you can depend to serve your consumers.

5.Unified Commerce

Unified commerce means combining customer and product data so that retailers can provide accurate and relevant information and offers to each customer. It can thus be said as a way to analyze all he data and bring into single stream in order to understand customer behavior

Unified commerce has the following benefits-

- better customer experience

- reduced operational cost

- zero duplication

- easy communication between multiple platforms

- decreased integration costs

- reduction in errors

- enhanced accessibility

- easy e-commerce payments

- real-time accurate visibility.

- integrating all sales channels

Unified commerce offers the businesses an exclusive online experience of-

- M-commerce

- e-commerce

- inventory management

- customer relationship management (CRM)

- order fulfillment

- catalog management

- point-of-sales capabilities (POS)

- financial management

Unified commerce is beyond omnichannel capabilities and leveraging the benefits of a common, centralized commerce platform for supporting your business growth.

Recent Digital Payment Innovations in various countries

- Hong Kong based digital banking solution provider Wallyt has announced its partnership with NIC Asia Bank to launch WeChat Pay and UnionPay QR payments in Nepal. With 25,000 and more QR merchants all over the country, NIC ASIA Bank, FirstPay and Wallyt will work together to offer more digital payment service to meet the requirement of local merchants and users, and help make the country’s economy a cashless economy.

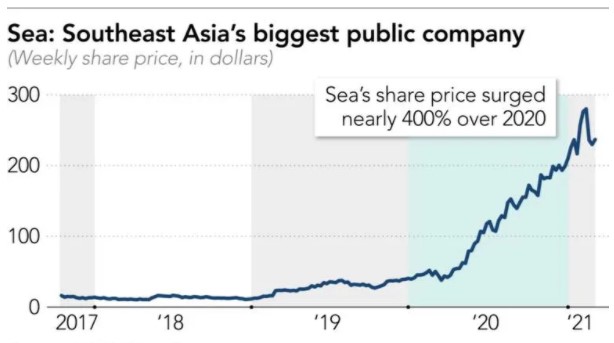

- With the pandemic as everyone turned to ecommerce, a surge was noticed in the digital payment softwares and this motivated competition among the existing digital payment software providers. Like, in Indonesia, ShopeePay which is a digital payment service provider offers upto 30% cashbacks on purchases done through their portal. That made Shopee’s parent, Sea Ltd., one of the most successful companies of the pandemic. As a result, its New York Stock Exchange-listed share price rose 395% in 2020.

- Xendit is the fastest growing digital payments infrastructure for Southeast Asia. It recently announced that it has raised US$64.6 million in a Series B round led by Accel to deliver more secure and reliable economic success in the region. Altogether, the company has raised $88 million in funding. Amid Southeast Asia’s rapid digital transformation, Xendit is quickly bolstering businesses of all sizes, processing more than 65 million transactions with US$6.5 billion in payment value annually.

- According to the Credit Suisse Group AG online payment industry in India is gonna reach $1 trillion by 2023. The stagnant market of Credit Cards needed a push which was given to it by the introduction of vCard which is a digital credit card incorporating multiple tech innovations. It is different from the plastic credit cards as it is the only Credit Card using UPI, which is said to have a larger acceptance for both P2P(People to People) and P2M (People to Merchants) payments. Digital cards are more secure than plastic credit cards as there is no chance of physical card theft. There is no card data on the device and the mobile phone acts as an authentication device.

- The COVID-19 pandemic has definitely had a positive impact on the online payment industry as it made the consumers embrace e-commerce. A trio of startups — Stripe, SumUp and Pledg. Stripe ( Californian startup firm), Sum Up( British firm) and Pledg( French startup) together were able to raise more than 1.5 billion euros in the last week which put them in the competition with the other giants of this industry like Alipay, PayPal, Apple Pay and Visa.

Digital payments are our future. It is very much expected that in coming years we will see payment methods transitioning from physical cash to the digitalization in various ways. During that period many new trends will appear and disappear. But it would play a vital role in shaping our future payment methods. Many of the above mentioned trends will also play a major role in that process. But only with time we would be able to know that which digital payment trend would stay and influence the market and which won’t.